TradingClue – Your Bitcoin Briefing & Signals

AI-powered morning insights (news, sentiment, technicals, on-chain), a weekly wrap & outlook, clear signals via Telegram – plus access to an invite-only PineScript strategy.

- ✔️ Daily Bitcoin Briefing

- ✔️ Weekly Newsletter with wrap & outlook

- ✔️ Signal Feed via Telegram

- ✔️ Invite-only PineScript Strategy (may outperform buy-and-hold in certain setups — no guarantee)

Cancel monthly • Instant access • Not financial advice

Intro Offer

- • Daily Bitcoin Briefing

- • Weekly Wrap & Outlook

- • Telegram Signal Feed

- • Invite-only PineScript Strategy

Secure payments via Stripe. Cancel any month.

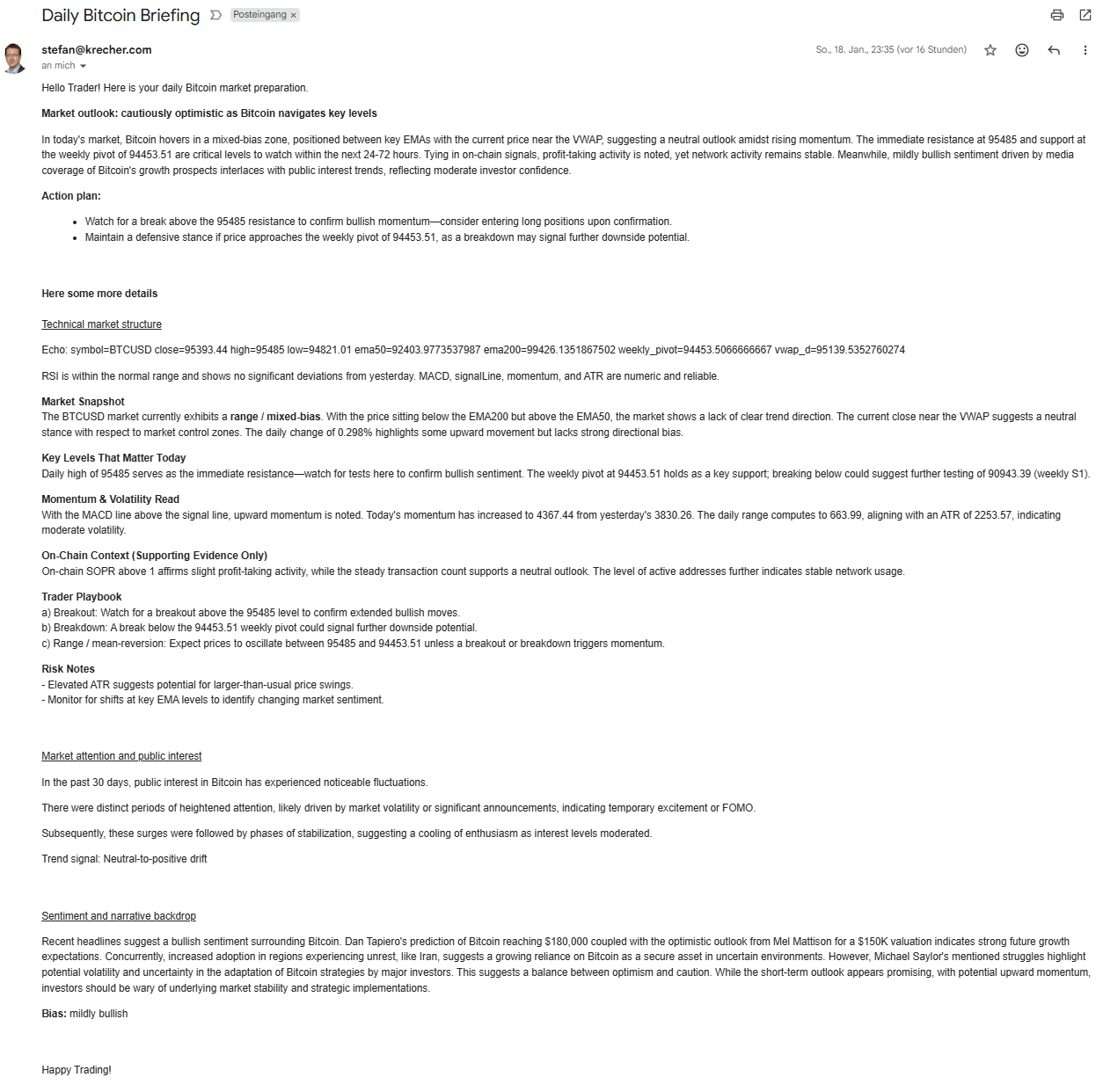

Daily Bitcoin Briefing

Data driven & AI-generated every morning: curated news & macro, sentiment, key technical levels, and relevant on-chain signals. Full briefing by email; concise summary with actionables to Telegram.

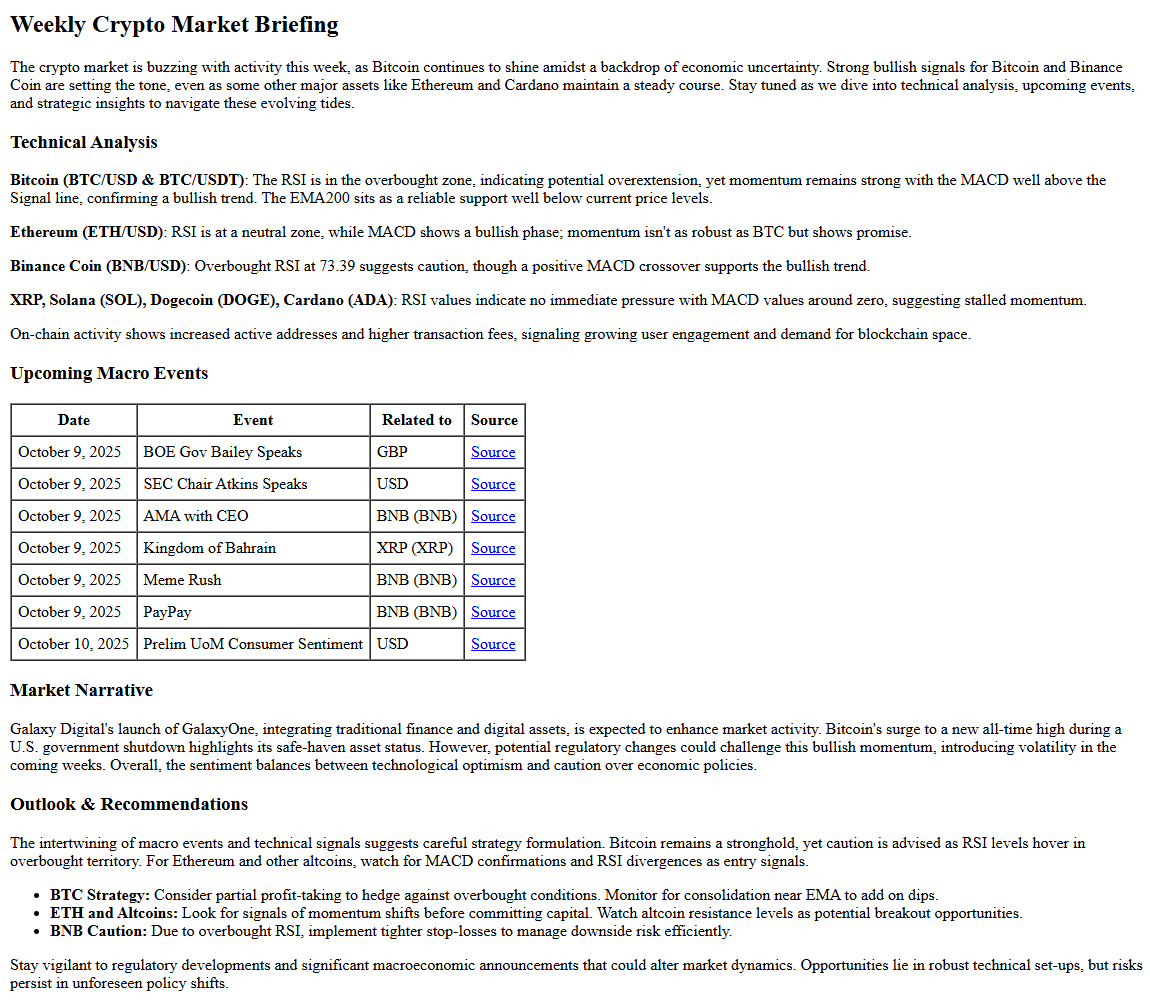

Weekly Outlook

AI-assisted weekly newsletter: objective wrap-up, forward scenarios, and next week’s key events (economic releases, protocol updates, expiries).

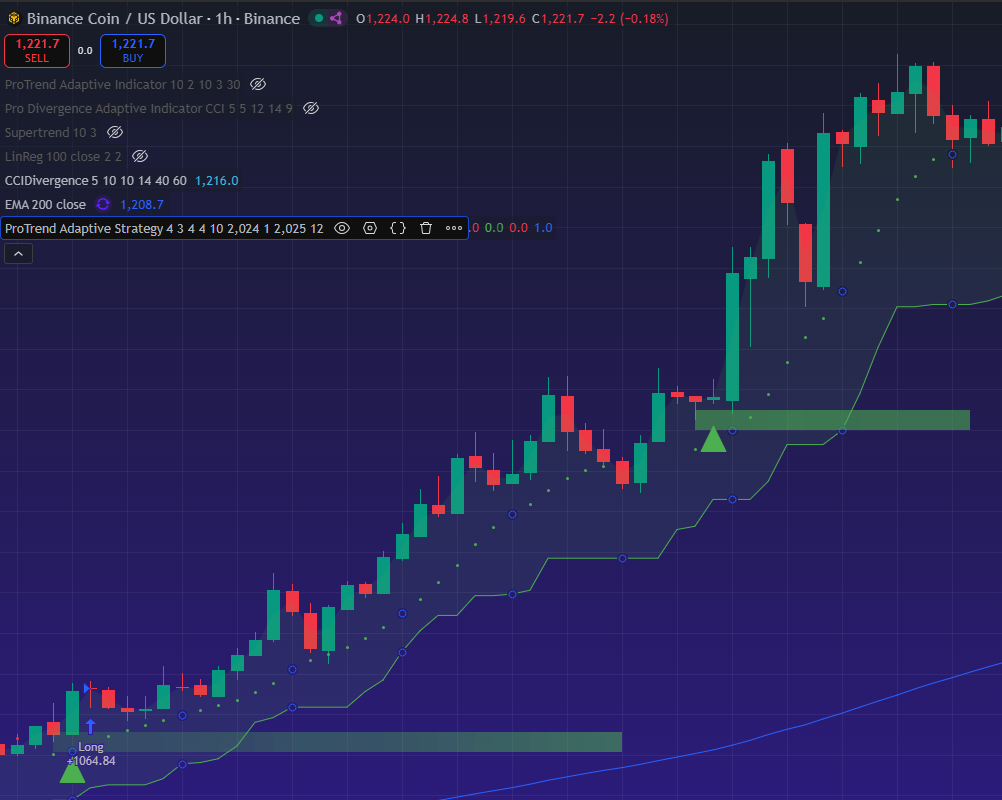

Signals (TG)

Backtest-driven signals for BTC, ETH and BNB delivered to Telegram. More pairs coming — trader requests welcome.

Manual Insights

Regular discretionary analysis posts in Telegram to complement the systematic signals.

How it works

- Complete your payment on Stripe.

- Within a few hours you'll receive the relevant onboarding steps.

- Join the Telegram channel & request TradingView access (we help with good starting parameters).

Transparency & Risk Disclosure

No investment advice. Crypto trading involves risk; total loss possible. Past results are not a reliable indicator of future performance.

Signals and content are for information & education only.

Daily briefing (email snapshot)

News • Sentiment • Technicals • On-chain — concise, prioritised, and ready for action.

Weekly newsletter (preview)

Objective wrap + forward plan, including next week’s high‑impact events.

Signal coverage

Primary coverage • backtest-driven + discretionary notes

Backtest-driven signals to Telegram

Backtest-driven signals to Telegram

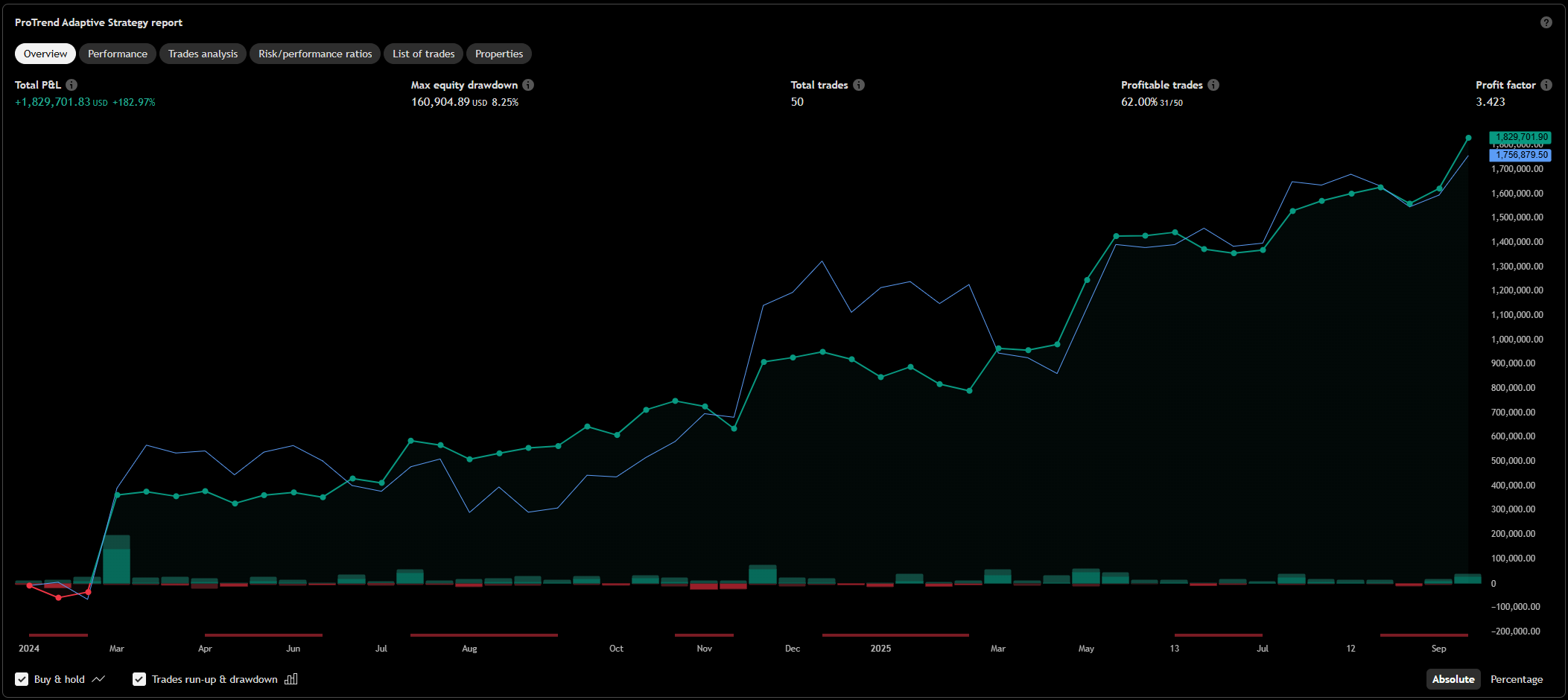

Strategy backtest (snapshot)

Example results for the invite‑only TradingView strategy on BTCUSD 4h with a recent configuration. Backtests are not guarantees of future returns.

- Total P&L: +182.97%

- Profit factor: 3.42

- Max drawdown: 8.25%

- Profitable trades: 62% (31/50)

- Total trades: 50

- Period: Jan 2024 – Sep 2025

- Baseline: Buy‑and‑Hold (BTCUSD 4h)

In the chart below, the blue line represents Buy‑and‑Hold, while the green line shows the performance of the ProTrend Adaptive Strategy.

No investment advice. Results vary by market conditions and parameters.